Context and background

A data broker is a company or individual specializing in the collection, purchase, analysis and resale of personal or commercial data. This data comes from a variety of sources, including websites, social networks, loyalty cards, public records and online transactions.

Data brokers have been around since the 19th century, long before the digital age. Originally, companies such as Dun & Bradstreet (1841) collected information on companies' creditworthiness. With the advent of computerization in the 20th century, companies such as Experian, Equifax and TransUnion automated the collection of financial and marketing data.

The rise of the Internet in the 1990s led to an explosion in the sector, with the emergence of giants like Acxiom and Oracle Data Cloud, specialized in the collection and sale of personal data for advertising and other uses. Today, data brokers play a key role in the digital economy, amassing billions of profiles from the traces left online.

How their database enrichments work

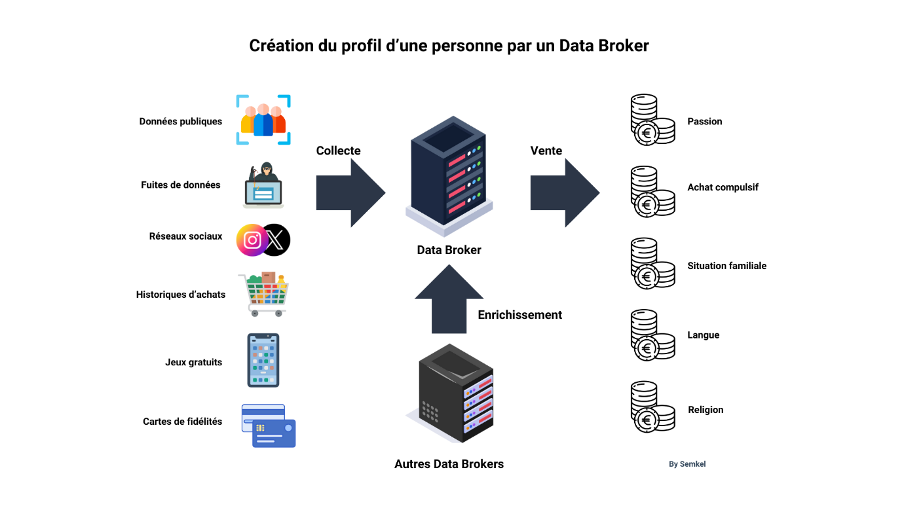

Data brokers enrich their databases by collecting, consolidating and analyzing data from multiple sources. This process makes it possible to cross-reference and refine information to create accurate, usable profiles.

The first step is to collect and acquire data from a variety of sources. Data brokers retrieve information online through cookies, advertising trackers and browsing on websites and social networks. They also exploit mobile data from applications that share users' location and usage habits. Commercial transactions are another important source, including online purchases, loyalty programs and credit card payments. Then there's the public data available in electoral registers, company files and government databases. Finally, data brokers can also purchase information from third-party partners, such as other data brokers, marketing companies or financial institutions.

Once collected, this data undergoes a cleaning and structuring phase. This stage is essential for eliminating duplicates, correcting errors and harmonizing formats, so as to obtain a reliable, usable database.

Information is then cross-referenced to enrich profiles. For example, browsing data can be combined with purchase history and location information to better understand an individual's behavior. This process refines profiles and makes them more relevant to companies wishing to exploit them.

Next comes data analysis and segmentation. Using Big Data tools and artificial intelligence, data brokers analyze trends and classify individuals into different segments, such as potential consumers or at-risk profiles. This classification makes it possible to predict behavior and anticipate customer needs.

Finally, enriched databases are resold to various companies who use them for a variety of purposes. Marketing companies use them to target their advertising campaigns and propose ultra-personalized offers. Banks and insurance companies use the data to analyze risks and adjust their services accordingly. Other companies use it to track consumer trends and refine their sales strategy.

How is a data broker used in practice?

Data brokers are key players in the exploitation of personal and professional data. Their enriched databases are used by various sectors to refine their commercial strategies, assess financial risks or analyze consumer behavior.

One of the main uses of data brokers' services is in marketing and targeted advertising. Advertisers buy detailed datasets to refine their advertising campaigns and precisely reach consumer segments. With this information, they can personalize advertisements delivered online, on social networks or by e-mail according to users' interests, purchase history or location. For example, someone who has recently searched for a specific product might see tailored ads on different platforms.

Companies in the banking and insurance sectors also exploit the data provided by data brokers to analyze financial risks. Insurance companies use this information to assess the likelihood of an individual making a claim, based on his or her behavioral history or lifestyle habits. For their part, banks rely on these databases to allocate credit, adjust interest rates or detect possible fraud by spotting suspicious transactions.

In the field of human resources and recruitment, some companies consult enriched databases to find out more about candidates before hiring them. They can check their professional history, analyze their online reputation or assess their financial stability. These practices enable employers to get a better idea of applicants' profiles and avoid potential risks.

Market research and business intelligence is another area where data brokers play a key role. Companies use this data to better understand consumer trends, adapt their offers and identify new business opportunities. For example, a retail chain can use these analyses to find out in which regions to open new stores, or which products to prioritize according to local habits.

Finally, data brokers are also used for surveillance and security purposes. Some governments or specialized agencies buy data sets to track suspicious behavior, spot criminal activity or monitor individuals considered a potential threat. This information makes it possible to cross-reference several sources and reconstruct patterns based on elements such as transactions, geolocation or online communications.

Data brokers have thus become essential intermediaries in the data economy. Their role is essential for companies and institutions seeking to refine their decision-making through the massive exploitation of personal and behavioral information. However, this activity raises ethical and legal issues, particularly in terms of privacy protection and transparency in the use of collected data.

How to limit indexing in their databases

Protecting yourself from data brokers and limiting the exploitation of your personal information may seem complex, but there are several measures you can take to reduce your exposure. These include adopting good online practices, managing your privacy settings and exercising your data protection rights.

The first step is to reduce the amount of information shared on the Internet. It is advisable to avoid providing personal data when it is not necessary, such as when registering for a service or loyalty program. It is also preferable to use aliases or secondary e-mail addresses to limit traceability.

It's essential to control your privacy settings on social networks and online platforms. Most sites offer the possibility of restricting access to personal information, preventing ad tracking or even disabling data collection via specific options. Deleting old accounts and avoiding sharing sensitive information on forums or public comments also helps reduce the risk of indexing.

Another effective lever is the use of privacy tools. Installing browser extensions that block third-party cookies and trackers, such as uBlock Origin, Privacy Badger or Ghostery, limits data collection. Opting for privacy-friendly search engines, such as DuckDuckGo, and using a VPN allows you to mask your identity and location while browsing. The use of unique e-mail addresses, such as the aliases in the ProtonPass solution, also reduces risks.

It is also possible to request the deletion of one's data from data brokers. Numerous platforms, notably in Europe thanks to the RGPD and in California with the CCPA, allow individuals to exercise their right to erasure. Some specialized sites, such as JustDeleteMe (Manually) or Incogni (Paid service), list data brokers and explain how to request the removal of one's information.

Finally, it's crucial to be vigilant about the permissions granted to mobile applications. Many applications collect personal information, such as location or contacts, and then sell it to third parties. It is therefore advisable to limit such access in the phone's settings, and to download only trusted applications.

The risks and challenges of indexing in data brokers' databases

Being indexed in the databases of data brokers raises many issues that can affect the privacy, security, economic opportunities and even fundamental rights of individuals. These companies collect and resell personal information without the explicit consent of the individuals concerned, which entails significant risks.

One of the first problems is the invasion of privacy. A person indexed in these databases loses control over his or her personal information, which can include identity, consumer habits, browsing history and even real-time geolocation. This data, once cross-referenced and analyzed, enables a detailed profile of an individual to be drawn up, without the individual being aware of it. As a result, Internet users can be tracked in their daily activities, social interactions and movements without ever giving their explicit consent.

The information gathered by data brokers is then put to massive use in the marketing and targeted advertising sector. Thanks to these enriched databases, companies can tailor their campaigns to consumers' interests and habits. While this practice may seem harmless, it represents a real risk of manipulation. A person seeking information on a health problem may be inundated by advertisements for expensive treatments, while an individual in financial difficulty may be targeted by offers of credit at high rates. By refining behavioral profiles, advertisers subtly influence purchasing decisions and exploit consumers' vulnerabilities.

Another major issue is discrimination and social exclusion. Many companies in the financial, insurance and recruitment sectors use these databases to assess an individual's profile. For example, a bank may refuse a loan or offer a higher interest rate based on data collected on a customer's consumption behavior. An insurance company can adjust its rates according to lifestyle habits deduced from recorded purchases and movements. In the field of employment, some companies can analyze a candidate's digital profile even before an interview, which can influence a hiring decision without the person concerned even realizing it. These practices, although discreet, create a form of invisible discrimination, where algorithms determine life opportunities on the basis of opaque and often questionable criteria.

Indexing in a data broker's database also exposes you to heightened cybersecurity risks. As these companies are prime targets for hackers, a data leak can have dramatic consequences. If sensitive information such as an individual's address, phone number or payment habits fall into the wrong hands, they become vulnerable to phishing attacks, attempted scams or even identity theft. Cybercriminals can exploit this data to access bank accounts, embezzle funds or set up sophisticated scams based on real information.

In addition to private players, data brokers' databases are sometimes exploited by governments and intelligence agencies, posing a problem in terms of mass surveillance and individual freedoms. In some countries, this information is used to monitor activists, journalists or political opponents, jeopardizing freedom of expression and democracy. The lack of control over the circulation of this data enables states to circumvent certain laws and profile individuals without a judicial warrant.

Finally, one of the biggest challenges associated with indexing in data brokers' databases is the almost total impossibility of deleting this information. Even if certain regulations, such as the RGPD in Europe or the CCPA in California, make it possible to request the deletion of one's data, these steps are lengthy and rarely effective. Once collected, personal data is continuously resold to other market players, making it particularly difficult to delete. Information deleted from one platform may still be available elsewhere, circulating between different data brokers.

Security risks associated with geolocation of employees on business trips

The use of geolocation for business travel raises major security issues. Without being aware of it, employees can expose sensitive information about their journeys, their whereabouts and even their homes, which can lead to risks of espionage, cyber-attacks or physical threats.

One of the first dangers is economic and industrial espionage. When employees frequently travel to specific destinations to meet partners, negotiate contracts or explore new markets, the collection and analysis of their location data can reveal strategic information. Competitors or malicious entities could monitor these movements to anticipate a company's decisions, identify its suppliers or understand its lines of development.

Cybercriminals also exploit geolocation to carry out targeted attacks. By analyzing an individual's travel habits, they can orchestrate more effective phishing attempts, impersonating a nearby hotel or business partner. What's more, some applications accessing location data can be compromised and transmit this information to third parties without the user's consent, increasing the risk of exfiltration of sensitive data.

The question of privacy and physical security is also a major issue. Excessive exposure of geolocation information can enable malicious individuals to identify an employee's home, especially if they activate their location services outside working hours. This vulnerability is particularly critical for executives or employees in strategic positions, who may be the target of burglary, kidnapping or blackmail attempts. By tracking a person's movements, it becomes possible to anticipate their comings and goings, and exploit this information for criminal purposes.

Finally, some local legislation imposes constraints on the use of location data, particularly when traveling to countries where government surveillance is ubiquitous. In these contexts, local intelligence services can exploit geolocation data to monitor the activities of foreign visitors, identify their contacts and exert pressure on them based on their movements.

Conclusion

Faced with the growing threat posed by data brokers, proactive protection of your sensitive and strategic data is more essential than ever. At Semkel, we put our business and cyber intelligence expertise at your service to help you anticipate these complex risks. Thanks to our constant monitoring of the dark web, our in-depth audits and our advanced prevention solutions, we can help you optimize the security of your critical information. Let's work together to preserve your economic, digital and reputational security in a world where your data is your most precious asset.

Sources :

https://www.lemonde.fr/pixels/article/2025/02/12/donnees-personnelles-en-vente-libre-les-data-brokers-une-industrie-hors-de-controle_6543025_4408996.html

https://www.lesechos.fr/2018/01/lapplication-strava-revele-la-position-de-bases-militaires-secretes-983049